Waiting to buy a home in today’s market could cost you more in the long run. Learn why acting now—despite mortgage rates—might be the smartest move for future homeowners.

As a self-employed buyer, securing a mortgage can feel daunting. Discover how non-QM loans can simplify the process and help you achieve your homeownership dreams.

Mortgage rates have dropped to their lowest levels since December, making homeownership more affordable. Learn what this means for buyers and sellers in today’s market.

Learn how capital gains taxes work when selling your home and how to reduce what you owe. Consult a tax professional for personalized advice.

Mortgage demand is surging as rates drop. Don’t wait—now’s the time to apply and lock in your opportunity before competition heats up.

Mortgage rates have dropped to a 4-month low, creating new opportunities for homebuyers and homeowners looking to refinance. Learn how to take advantage of lower rates today.

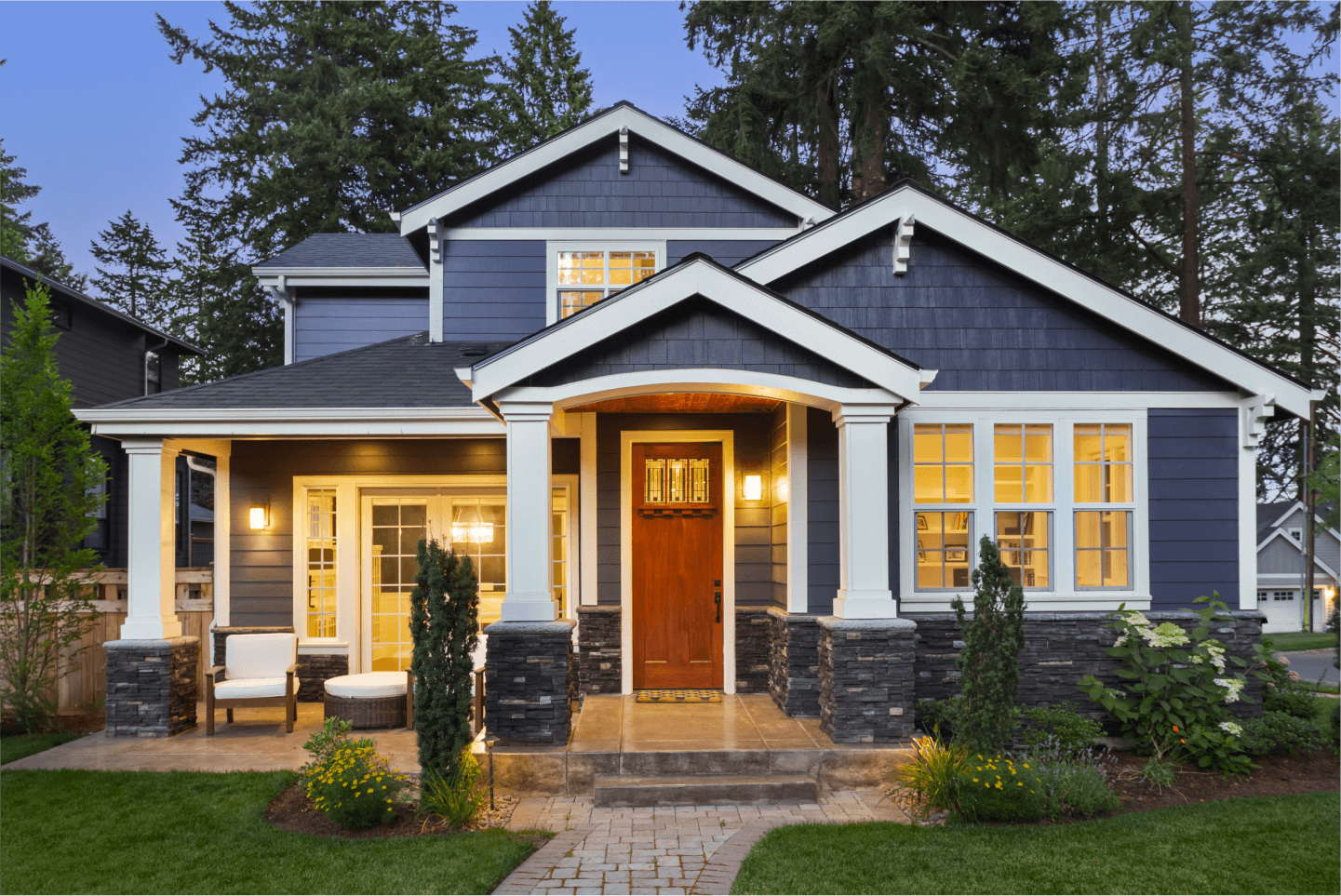

In 2025, buying a home is more affordable than renting in most U.S. markets. Learn why homeownership remains the smarter long-term investment.

Home prices are rising at a steady pace, creating great opportunities for buyers and sellers in 2025. Learn how this balanced market benefits you!

Thinking about moving in 2025? Learn why so many Americans are relocating and how to turn your dream move into reality with the right planning